From a broken engine a decade ago, Southern Europe has become the workhorse of the post-pandemic European recovery. In the future, climate change and inflation will make it hard for the tourism boom to last much longer. What could be the consequences and solutions to help these countries bounce back? Our experts tell you all about it in our study, which you can download in the left column.

After collapsing due to travel restrictions to combat Covid-19, tourist numbers are now returning to pre-pandemic levels across Europe, with Mediterranean countries benefiting all the more. From a broken engine a decade ago, Southern Europe has become the workhorse of the post-pandemic European recovery.

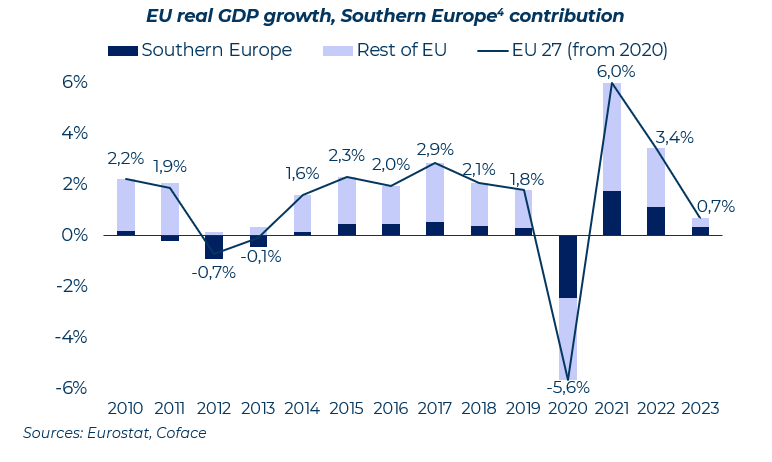

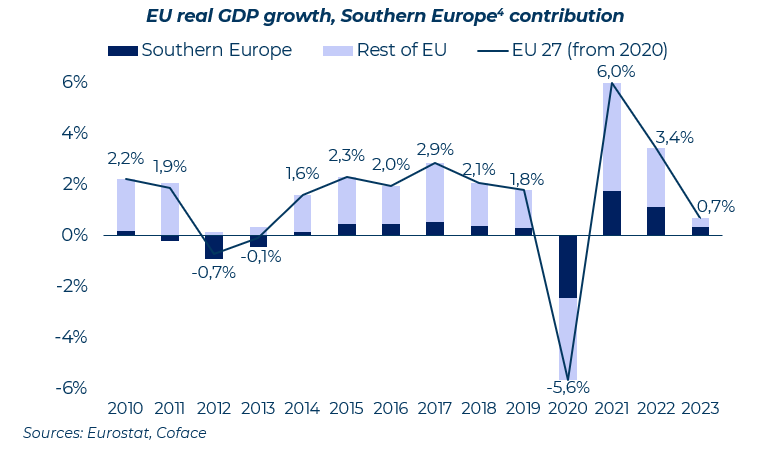

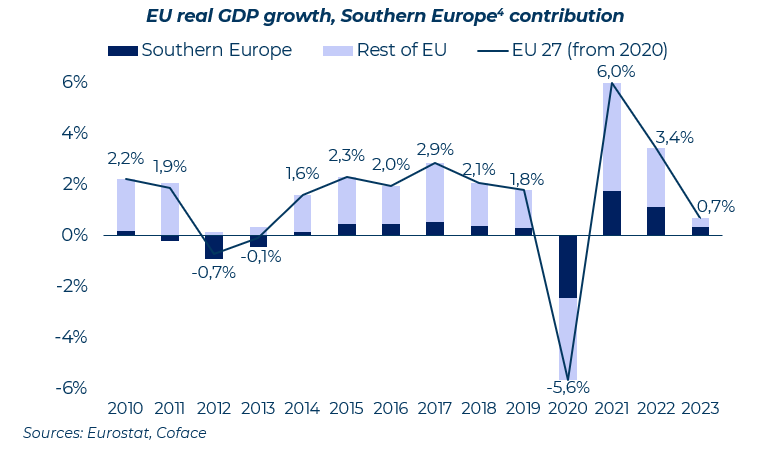

In 2021-23, Italy, Spain, Greece and Portugal have consistently accounted for between a fourth and half of EU GDP growth. In the future, climate change and inflation will make it hard for the tourism boom to last much longer. At the same time, tourism dependence leads to a less productive workforce. Facing a severe demographic crisis, this is a luxury that Italy cannot afford. Artificial intelligence, women, and migration: all these levers will be needed to support growth and comply with the returning EU fiscal rules.

The growing role of tourism in Southern Europe

The EU recorded a record-breaking summer, with the number of nights spent in tourist accommodation reaching its highest level for a decade (1 198 million in H1 2023, i.e., +1,3% compared to H1 2019).

Although inflation and rising travel costs are weighing heavily on consumers' wallets, households remain willing to spend on travel compared to other expenses. As a result of this tourist inflow, but also of rising prices, especially for transport, turnover of tourist activities rose by an average of 30% in Q2 2023 compared to Q2 2022, and by 25% compared to 2019 .

Tourism recovery is expected to play a central role in the growth resilience of Southern Europe whose economies are particularly dependent. The sector accounts for over 10% of the GDP of countries in this region and is an important contributor to job creation, given that it is a labor-intensive sector.

Long-term traps

Looking ahead, it is not clear that the tourism boom has enough gas in the tank to continue being a protagonist in the European growth story. Multiple risks (macroeconomic, financial, social, and political) persist on a global scale. In an inflationary world, it will be difficult for Southern Europe to remain cost-competitive against up-and-coming destinations in the emerging world. Climate change is having a particular impact on the regions of Southern Europe, which are regularly exposed to high heat during the summer .

On the other hand, Southern Europe reliance on tourism leads to a significant distortion in terms of productivity compared to the rest of Europe. Tourism-related activities are characterized by a weaker workforce with lower education and more precarious employment.

Italy’s labor shortages will get worse just as EU fiscal rules re-activate

The question of productivity is of upmost importance for Italy, where population decline means labor shortages are here to stay. By 2040, Italy’s working-age population is set to contract by 11.7%, vs 2.4% in France; 4.1% in Spain and 4.9% in Germany. Coface estimates that the demographic crisis can cut Italy’s GDP growth potential almost by half as early as 2025. This is of crucial importance as the EU fiscal rules come back into play because any obstacle to growth will be obstacle to debt reduction. Hence, population decline is a risk factor for fiscal sustainability.

The untapped potential of Italian women

On the short run, the most realistic way to avoid this is to strongly accelerate the recruitment of women into the labor force, like Spain in the 1990’s-2000’s. Only 55% of women in Italy hold formal employment, vs 70% in Spain. Italy needs to add roughly 1 million women to its labor force and raise productivity growth to an annual 0.5% if it wants to meet the fiscal commitments proposed to the EU in the 2024 budget (and implicit in the EU fiscal rules).

If policies aimed at women’s work and productivity underperform, there will be a greater need for foreign workers, with a growing role for less qualified labor. Between 2011 and 2021, the college-educated workforce increased by 35%, while the workforce without a college diploma contracted by 6%.

A.I. and population decline: a match made in heaven?

Even if Italy succeeds in matching the participation and fertility rates of its neighbors, it will be a matter of years before the demographic problem re-emerges. Any long-term solution to population decline will involve large-scale efficiency gains. If adopted fast enough, A.I. shows great potential to durably boost productivity, perhaps enough to compensate for the demographic drag.

Conversely, if concerns for A.I.-driven job displacement materialize, then a declining population could help alleviate the ensuing unemployment problem.

1 and 2 Source Eurostat

3 A recent ETC survey reveals that while weather conditions remain the main factor considered by European travelers when choosing their travel destination, 14% of respondents also mentioned extreme weather events as an additional concern, i.e. 7% more than in the May 2023 survey.

4 Italy, Spain, Greece, and Portugal

Download the full publication for an in-depth analysis.